Could Bitcoin Set New Records After Shaking Off Overleverage?

Posted on 19/03/2024 | 502 Views

BTCUSD witnessed a 12.5% dip in its value from March 14 to March 17, descending to AU$98,411.85 (US$64,545), which sparked significant buying interest around the AU$99,168 (US$65,000) level. Currently, despite the clearance of excessive leverage in Bitcoin futures, the community is evaluating whether BTC can breach its record peak of AU$112,390.98 (US$73,755).

Federal Reserve’s Monetary Policy Meeting in the Spotlight

There's speculation that investors are holding off on further cryptocurrency investments until the U.S. Federal Reserve's (Fed) monetary policy meeting on March 20, amid broad anticipation that interest rates will hold steady. This anticipation extends beyond immediate concerns, focusing on the Fed's assurance of the robust continuation of the economy.

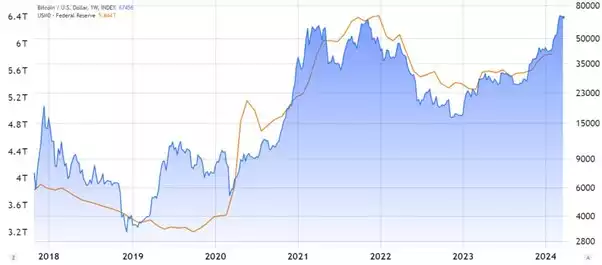

Another vital aspect of Bitcoin's future is the timeline for the Fed to halt the reduction of its AU$11.44 trillion (US$7.5 trillion) balance sheet. Generally, a more expansive Fed monetary stance implies more circulating money, favouring risk-on assets like Bitcoin.

U.S. Base Money, reflecting currency and reserves within the banking system, is typically curtailed through higher interest rates. This strategy, aiming to moderate or decrease money supply, discourages borrowing and expansion, helping to manage inflation.

Some analysts predict that Bitcoin's potential rally in 2024 is closely tied to the Fed shifting from contractionary to expansionary monetary policies. Such a move could be triggered by inflation dropping below 3% or the economy showing downturn signs. Hence, a prolonged period of high interest rates might dampen the prospects of a Bitcoin rally.

Bitcoin Futures and Stablecoin Demand Indicate a Positive Outlook

The anxiety around excessive leverage among Bitcoin investors, especially with the open interest in BTC futures reaching a record high in March, from AU$33.81 billion (US$22.2 billion) on Feb. 25 to AU$53.98 billion (US$35.5 billion) on March 14, has been a concern. Additionally, the leverage demand imbalance led to market distortions that are typically unsustainable.

Perpetual contracts feature a periodically adjusted rate every eight hours. A high funding rate suggests growing leverage demand from long-position holders.

A notably high funding rate of 0.09% was recorded on March 11, equating to 1.7% per week. This rate saw a decrease as bulls encountered AU$564.9 million (US$370 million) in liquidations from March 13 to March 15. While these figures might appear substantial, given Bitcoin's AU$53.1 billion (US$34.8 billion) open interest, it represents only about 1% of positions being forcibly closed.

By March 15, Bitcoin’s funding rate moderated to 0.25% per week, indicating a neutral stance in a predominantly bullish market. This suggests bears were cautious about wagering on Bitcoin prices dropping below AU$99,168 (US$65,000).

Assessing the reduced leverage demand's reflection of market sentiment necessitates examining the demand for stablecoins in China, a key metric for retail investor activity. The USD Coin (USDC) premium, measuring the gap between peer-to-peer USDC transactions and the official U.S. dollar rate, has maintained above 3% in the past week, highlighting that the stablecoin is trading above its pegged rate. Importantly, even amidst the price correction to AU$98,411.85 (US$64,545) on March 17, this premium hasn't dipped below its fair value.

This indicates sustained cryptocurrency demand in China, reinforcing the optimistic Bitcoin funding rate for long positions and showing no bearish sentiment or investor hesitation signs.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto's team at 1800 296 865 or via [email protected]. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.