Bitcoin's Bull Run Continues: Analysing the Surge and Potential for a Market Squeeze

Posted on 14/03/2024 | 425 Views

As the cryptocurrency market adapts to global trading hours, Bitcoin (BTC) has left traders and analysts in awe with its latest price actions.

Recently, the world's preeminent digital currency, Bitcoin, experienced a striking volatility spike, piercing through the AU$110,380 (US$73,000) mark in a dramatic surge. This uptick in market activity comes on the heels of the much-anticipated approval of the Bitcoin Spot ETF, setting off a bullish frenzy in the weeks that followed.

Bitcoin's price journey has been nothing short of a rollercoaster, with its value skyrocketing beyond AU$110,380, plunging to AU$104,378 (US$69,000), and then bouncing back over the AU$105,952 (US$70,000) threshold in the span of mere hours. At the moment, Bitcoin continues to carve out new records.

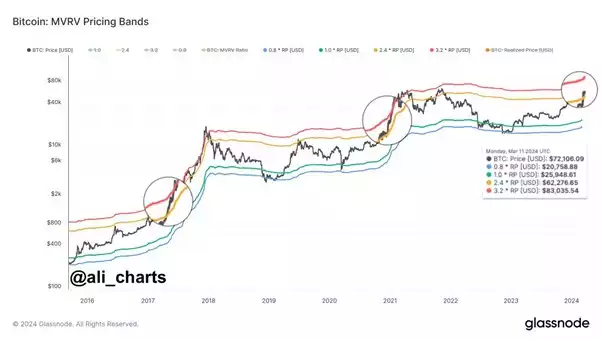

Amid this whirlwind of bullish behaviour, speculation abounds regarding Bitcoin's next milestones. Utilising the Bitcoin MVRV Pricing Bands, an analysis tool that juxtaposes the market value against the realized value, prominent cryptocurrency expert Ali anticipates a significant target for BTC at AU$125,636 (US$83,035).

This anticipated climb raises the spectre of a sell-side liquidity crunch, a scenario where short sellers find themselves overwhelmed by a market fervently buying into Bitcoin's ascendancy. As pointed out by Ki Young Ju, CryptoQuant's CEO, should Bitcoin Spot ETF inflows persist, the resulting demand surge could eclipse available supply, leaving bears at a disadvantage.

Ju's analysis sheds light on the profound influence that institutional investment tools are exerting on Bitcoin's supply dynamics. These ETFs are not mere market players; their acquisitions, amassing nearly AU$45.34 billion (US$30 billion) worth of Bitcoin in a single week, are reshaping the market's structural fabric.

Miners, too, are riding the wave of this financial upturn. As BTC's value climbs, so too does the revenue generated by mining, with daily rewards reaching a pinnacle of AU$119,229,266 (US$78.89 million). This figure surpasses the previous peak of AU$112,420,960 (US$74.4 million) recorded in October 2021, highlighting the lucrative outcomes of this current market rally.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto's team at 1800 296 865 or via [email protected]. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.