Bitcoin Breaks All-Time High in AUD – Here's Why It's Only the Beginning

Posted on 29/02/2024 | 960 Views

Bitcoin just hit an all-time high in AUD – driven by ETF inflows, global liquidity maturing from an early-cycle to a mid-cycle, alongside debasement of your AUD. Today we review the recent “Bitcoin Analysis: Beyond The Block” report from our Ainslie Research team which delves into how the market has outperformed all expectations.

If you prefer to watch our video report this article is based on, you can view it here.

Today we will be covering 2 categories from the video:

- Macro Economic Analysis

- Bitcoin Market Analysis

Macro Economic Analysis:

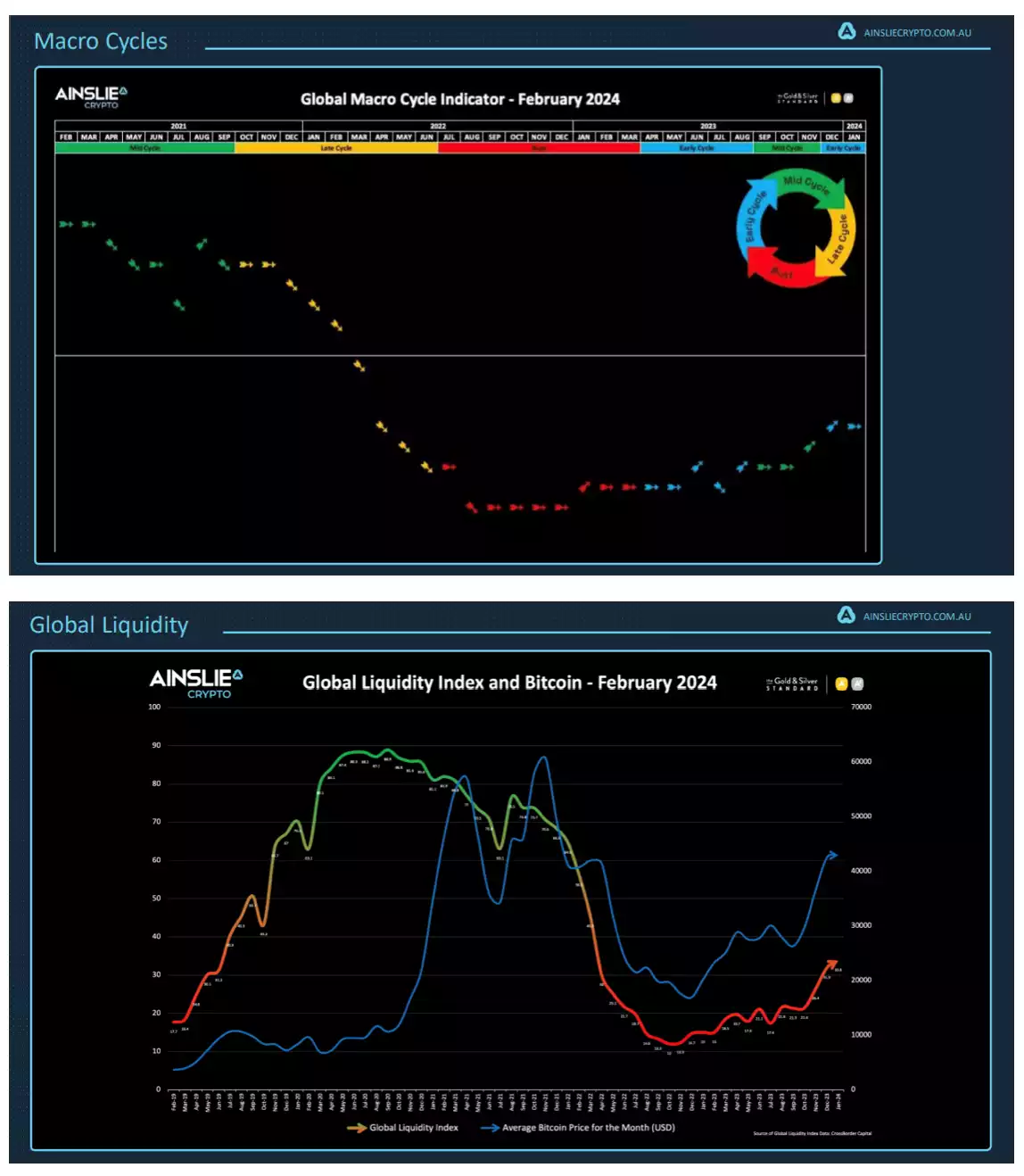

In the Macro Economic Analysis section, we delved into the significant influence of macroeconomic factors on the Bitcoin market. We discussed the intriguing link between the global money supply and Bitcoin investment, noting that an increase in global liquidity often correlates with heightened Bitcoin investment due to the availability of more funds - as you can see in the charts below. What’s most fascinating is that we are witnessing incredible Bitcoin performance while still early in the Global Macro and Liquidity Cycle – suggesting that there’s still significant upside potential. The money printers haven’t started churning and rates haven’t decreased yet…

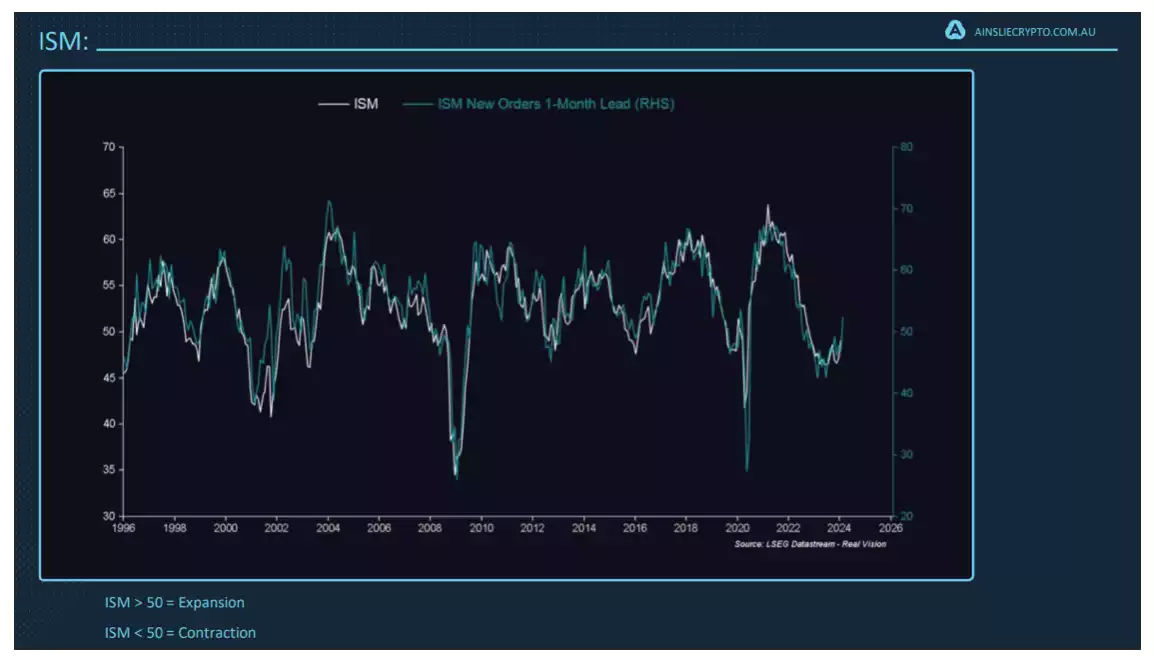

We also reflected on the impact of global economic trends on Bitcoin market dynamics. The discussion emphasised the value of economic indicators like the ISM Manufacturing Index and authentic inflation data.

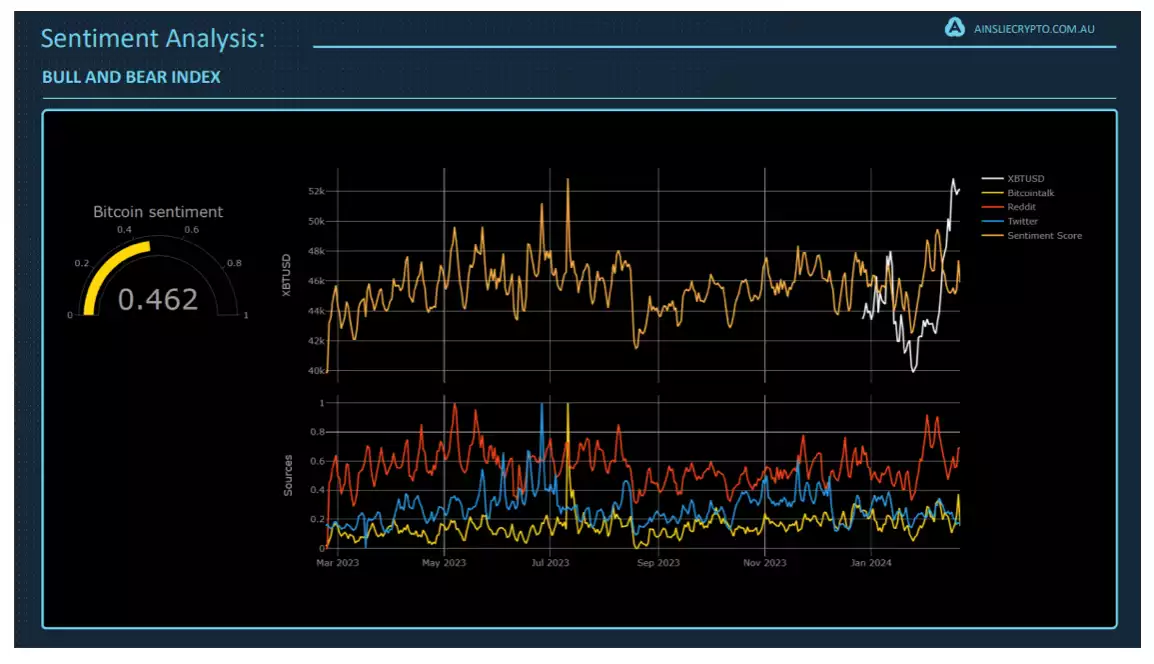

Moreover, we explored various investment strategies that incorporate the Fear and Greed Index alongside global liquidity. We warned against making hasty decisions based on the latest headlines or a narrow perspective of the market. Instead, we suggested a systematic strategy that includes understanding different metrics, identifying cycles, and linking them to broader market trends.

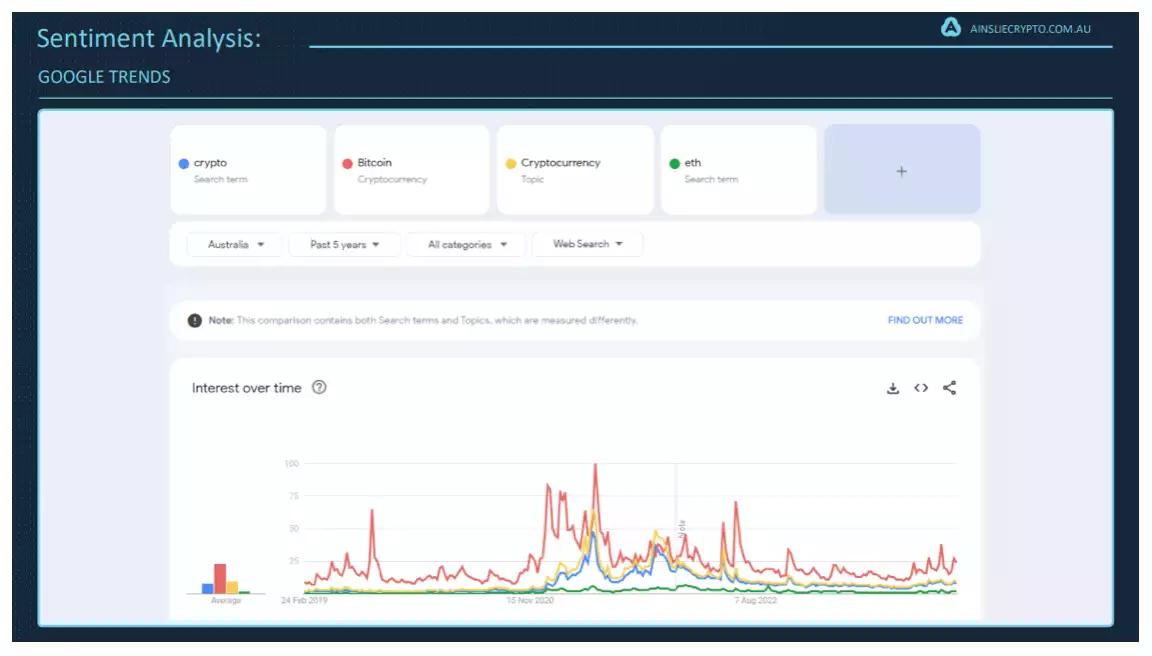

We also highlighted the role of tools like artificial intelligence and platforms that track sentiment on social media, as well as Google Trends data in the crypto space. These tools, we noted, can provide critical insights into the collective mindset of investors, which is crucial for informed decision-making.

An interesting aspect of our discussion was the current reduced retail participation in the Bitcoin market, which we saw as a positive sign.

Bitcoin Market Analysis: Exchange Traded Funds (ETFs)

Our discussion on this topic acknowledged the significance of Bitcoin ETFs within the cryptocurrency market, which have drawn both interest and scrutiny. Despite potential risks and concerns about their influence on prices, we viewed ETFs as a crucial element in shaping Bitcoin's market trends.

We highlighted the importance of comprehending the structure of ETFs and their possible implications on the market. We discussed incorporating ETFs into investment strategies to maximise benefits and minimise risks, all while considering the broader macroeconomic landscape.

We emphasised the value of maintaining a long-term perspective on the market and the importance of evaluating ETFs within this comprehensive context. We intend to keep this conversation going every month, tracking the evolving dynamics of the Bitcoin market and ETFs. Such discussions, we believe, will benefit both experienced investors and newcomers to the Bitcoin arena.

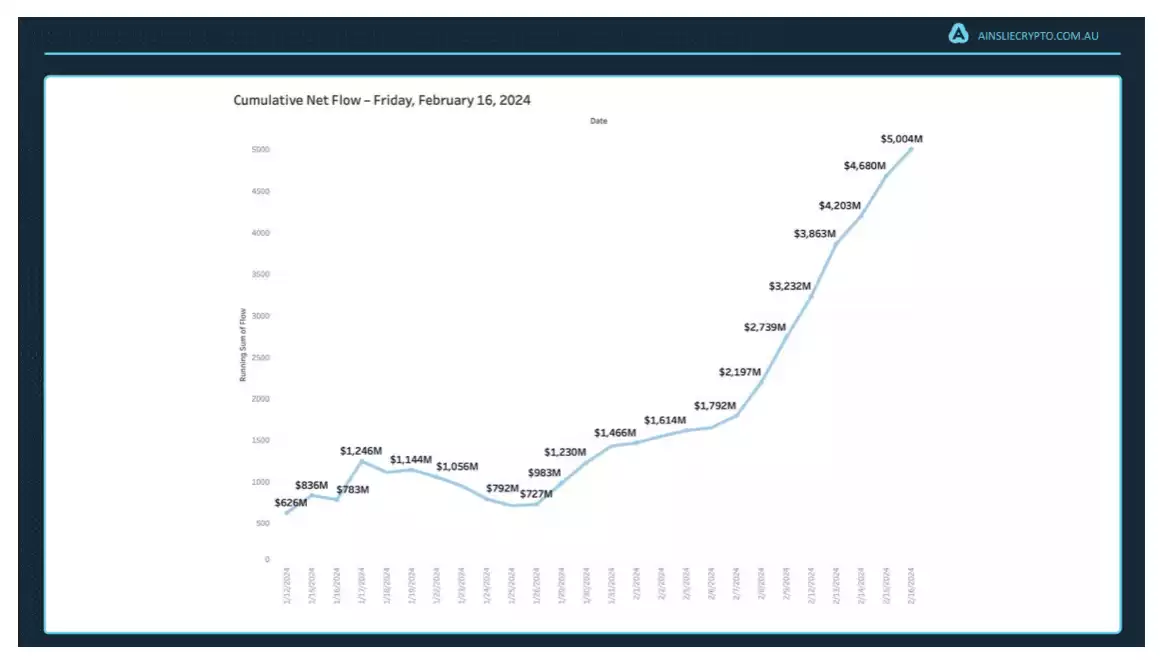

Reflecting on a moment of significant financial product innovation, we touched upon the record-setting launch of Bitcoin ETFs, marking the most successful introduction of an ETF in terms of fund inflows during its first month. Data on institutional holdings of Bitcoin and the increase in Bitcoin locked in ETFs, observing an initial surge in total net flows into ETFs, followed by a decline and then a resurgence, leading to a significant rise in Bitcoin allocation within ETFs. Since our discussion, ETFs increased from $5 billion in Bitcoin holdings to over $6 billion in 5 days – that’s nearly 1.5% of the total (21 million) Bitcoin which will ever exist.

We noted the substantial shift of Bitcoin from the Grayscale Bitcoin Trust (GBTC) into other institutional ETFs like BlackRock and Fidelity, attributed to factors such as greater trust, lower fees, and forced selling from GBTC. We also remarked on the swift ascent of ETFs in dominance, quickly surpassing MicroStrategy's Bitcoin holdings and expected to soon exceed GBTC.

To summarise, we emphasised the importance of adopting a comprehensive, macroeconomic approach when analysing Bitcoin. We explored the connections between global liquidity, economic indicators, ETFs, and Bitcoin market trends, highlighting the need for a deep understanding that goes beyond simple chart analysis to truly grasp the market's condition.

We talked about the necessity of developing strategies from a macroeconomic perspective and the challenge of identifying market peaks, which is often more difficult than pinpointing market bottoms. We encourage you to join us in these monthly discussions, aiming to progressively deepen our collective knowledge.

Our goal is to provide you with the insights and confidence needed to successfully navigate the volatile Bitcoin trading landscape. We value your feedback as it helps us tailor our information to better meet your needs.

About Ainslie Crypto:

Considering securing your cryptocurrency trading, purchasing, or exchanging strategies? Join us here or connect with Ainslie Crypto's team at 1800 296 865 or via [email protected]. We offer dedicated, personalised ‘human to human’ assistance to ensure the seamless, secure integration of cryptocurrency into your portfolio, whether for personal investment, business strategy, or your Self-Managed Super Fund (SMSF). Ainslie have been a trusted dealer and custody provider for Gold 1.0 for 50 years and bring the same service to Gold 2.0, Bitcoin, since 2017.

In an era where traditional banking systems impose increasing limitations, Ainslie Crypto offers a forward-thinking payment solution with the Australian Digital Dollar (AUDD) platform. Developed by Novatti, AUDD allows you to navigate beyond the constraints of conventional financial systems, offering stability, security, and ease in your crypto transactions.

Unchain yourself on-chain.

Want to swap directly between bullion and crypto? Ainslie seamlessly provide swaps between these two hard assets.

At Ainslie, our commitment extends beyond just transactions. We specialise in providing secure digital wealth protection. Our robust crypto custody services are backed by rigorous, real-time internal audits, ensuring your investments are not only secure but also managed with the highest standard of care and expertise. You can always see your own segregated wallet address and balance, value and trade history. Trust Ainslie Crypto to be your partner in navigating the dynamic world of digital assets, where we blend human insight with advanced technology to deliver a service that stands apart in the industry.